Bio-based materials refer to materials derived from natural biomass, including materials that use biomass as raw materials or (and) obtained through biological manufacturing. Bio-based materials are derived from renewable resources and have many advantages such as carbon reduction and sustainability.

With the introduction of the concept of carbon neutrality, bio-based materials, and even bio-based degradable materials, have received widespread attention due to their good environmental protection characteristics. What is the current supply and demand status of bio-based materials? What are the downstream distributions? Let's take a look below.

Demand in the EU market exceeds demand, and bio-based materials have broad room for growth

Biomass raw materials instead of petroleum-based raw materials, the combination of biochemical methods or biological methods are the key directions for the development of the chemical manufacturing industry. Bio-based chemicals refer to products such as bulk chemicals and fine chemicals produced using renewable biomass (starch, glucose, lignocellulose, etc.) as raw materials.

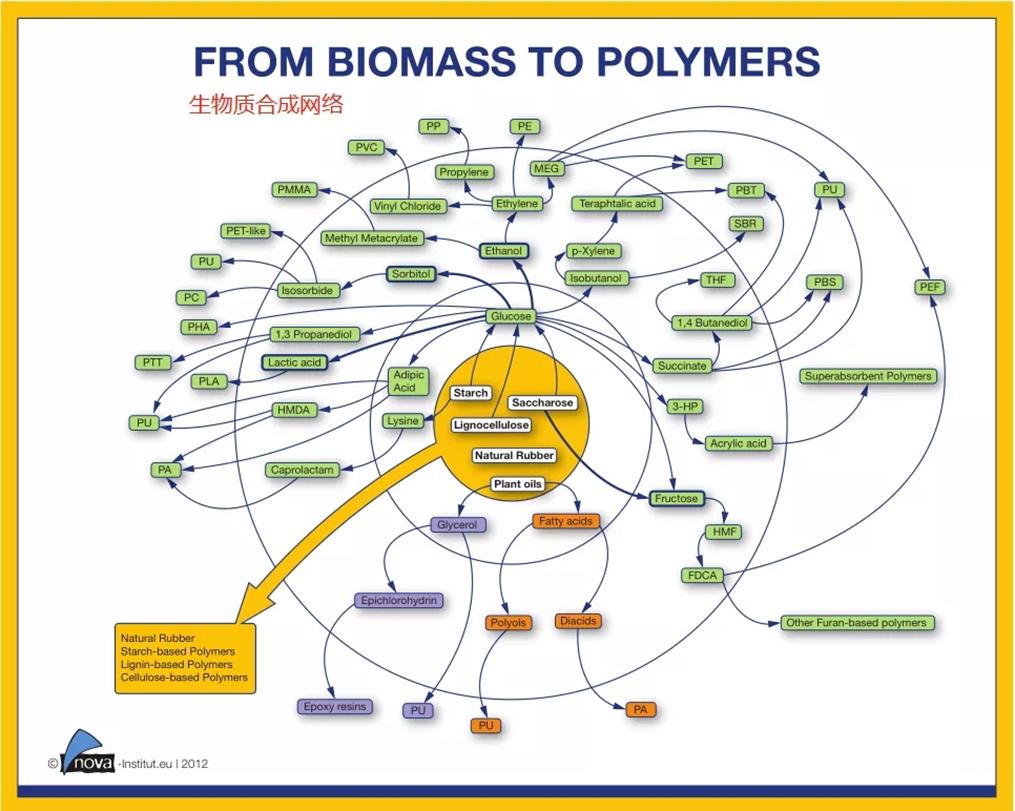

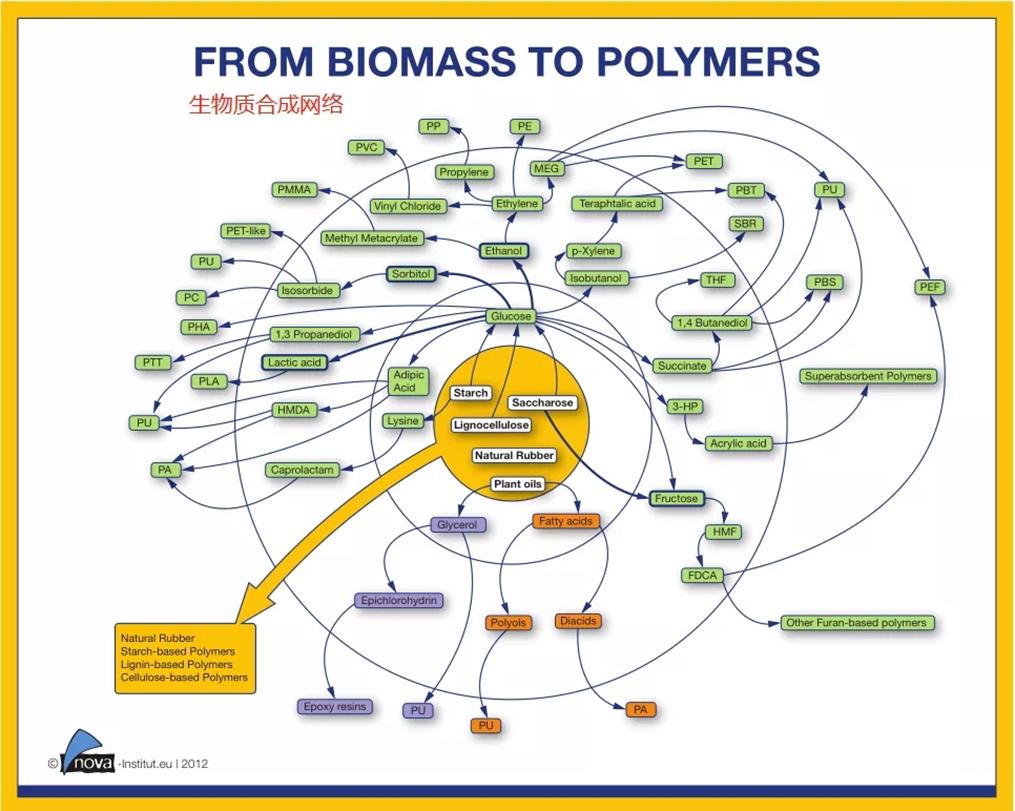

Nova Institute research shows that from a technical point of view, almost all industrial materials made from fossil resources can be replaced by bio-based materials. In recent years, advances in genomics, proteomics, metabolomics and systems biology related to biorefining technology have jointly constructed a biosynthetic network of chemicals and downstream materials.

In recent years, under the guidance of policies of various countries, the growth of biofuel production capacity has promoted the development of the bio-refining sector, while also accelerating the construction of the entire industrial chain of the agricultural sector-bio-refining sector-downstream manufacturers-certification agencies-consumer sectors, driving downstream bio-based chemistry The rapid development of products and new materials.

European bioeconomy has first-mover advantages. The RoadToBio project led by the European Union has planned a roadmap for the European chemical industry to move towards bioeconomy, with a view to realizing a diversified bio-based product portfolio.

The RoadToBio project subdivides bio-based products, including bulk chemicals, solvents, polymers for plastics, chemical fiber products, paints/coatings/inks/dyes, surfactants, cosmetics and personal care products, adhesives, lubricants, and plasticizers Agents and other fields.

As one of the world's largest consumer markets for bio-based chemicals and downstream materials, the EU has a large audience for products under the official long-term policy publicity. The EU bio-based product categories include 10 major categories (excluding biofuels) such as bulk chemicals, plastics, solvents, and surfactants. Among them, bulk chemicals and solvents are all basic chemicals, such as surfactants, personal care/cosmetics, and glues. Adhesives, lubricants and plasticizers are all fine chemicals, and paints/coatings/inks/dyes, plastics and fiber products are bio-based polymers.

In 2018, the EU market's bio-based chemicals and downstream output was nearly 4.7 million tons, the demand was nearly 5.5 million tons, and the output value was nearly 9.2 billion euros. There is a strong demand for bio-based products in the high-end consumer market. Among the series of bio-based products, the production of surfactants, paints/coatings/inks/fuels, fiber products and personal care/cosmetics is the largest. This is due to the higher consumption level in the EU market and the large demand for bio-based oils and fats. .

In terms of price, limited by the scale of production in the region, the price of basic bio-based chemicals is higher than that of petroleum-based products at this stage. As product categories become more refined, the closer to the end consumer, the lower the product price. The price gap narrowed. With the rapid progress of biosynthetic technology, the selling price of some bio-based fine chemicals (such as succinic acid, PA56) is even lower than the corresponding petrochemical products.

The penetration rate of bio-based chemicals and downstream in the EU market is only 3%, the future market growth space is 4 times, and the global market is expected to exceed 100 billion euros. According to JRC data, the total production of chemicals in the EU's corresponding sub-sectors in 2018 was nearly 160 million tons/year, and the proportion of bio-based chemicals was only 3%, especially in the bulk chemicals and plastics industries, which accounted for 77% of the total output, and the substitution rate of bio-based Only 0.7%.

According to the EU’s "Industrial Biotechnology Vision Plan", the minimum replacement rate of 6% for bulk chemicals and plastic products and 30% for fine chemicals is calculated. By 2030, the output value of bio-based products will reach 37 billion euros/year, compared with 9.2 billion in 2018 Euro output value, the room for growth reaches 4 times.

According to JRC data, the amount of new private investment in the above sub-sectors is expected to reach 19 billion euros from 2018 to 2025. Superimposed on the EU's bio-economy special plan investment that has continued to increase in recent years, there is a lot of room for future bio-based product replacement rates.

In addition to the EU market, the bioeconomy strategies of the United States and China are also being vigorously implemented. Assuming that the market size is equivalent to that of the EU, the global bio-based chemicals and downstream markets are expected to reach the level of 100 billion euros in the future.

There are many bio-based chemicals and downstream race tracks, and countries are accelerating to enter

The output of bio-based chemicals has grown rapidly in recent years. According to estimates by IEA Bioenergy, the total output of bio-based chemicals in 2019 will be nearly 10 million tons per year (excluding fuel ethanol), with a compound growth rate of nearly 10% from 2011 to this year.

At present, the world's main bulk bio-based chemicals include ethylene, ethylene glycol, propylene glycol, glycerin, butylene glycol, lactic acid, sebacic acid, etc., and biosynthetic technology has been industrialized.

Among them, the sugar-based compounds ethylene, ethylene glycol, propylene glycol, lactic acid, butylene glycol, succinic acid, pentane diamine, etc. are the key raw materials for downstream bio-based PE, PLA, PET, PBS, PTT and PBAT, etc. The oil-based compound glycerin, Long-chain fatty acids and fatty acids are used in the preparation of bio-based materials such as PHA, PA and epoxy resin.

1. Traditional petrochemical giants step up their layout on the big bio-based chemical circuit

Encouraged by government policies and plans, British Petroleum (BP), Shell, BASF, Dupont, Dow Chemical, Evonik, DSM DSM) and other large multinational petroleum and chemical giants have invested heavily in the biochemical industry to develop industrial biotechnology for bio-manufacturing.

The influx of a large number of new forces has accelerated the integrated construction of the industrial chain from bio-based chemicals to new materials.

Braskem is the world's leading producer of bio-based olefins and polyolefins. The company produces ethylene from the renewable resource sugarcane ethanol and launched green PE to the market in 2010. Now Braskem has 36 production bases in Brazil, the United States and Germany. Wait for the place.

Avantium is committed to the development and commercialization of next-generation bio-based chemicals and plastics. Its main business and technologies include the production of ethylene glycol (MEG) from plant-based industrial sugars, the conversion of plant-based monosaccharides (fructose) into various chemicals and Plastics (such as PEF), conversion of non-food plant materials into industrial sugar and lignin, conversion of carbon dioxide into high-value chemicals through electrochemistry, etc.

Lactic acid is a relatively large part of bio-based chemicals. It is mainly used for the production of downstream degradable and environmentally friendly new material PLA. Related companies mainly include Corbion in the Netherlands, Galactic in Belgium and NatureWorks in the United States. Corbion produces lactic acid and lactide. Sold to companies such as Synbra, the Netherlands, to further produce PLA foam materials; NatureWorks and Galactic are the leaders in PLA. The latter also recycles PLA materials and further degrades PLA products into lactic acid.

my country's bio-based chemical research started relatively late, but in the "Twelfth Five-Year" national science and technology support plan, bio-based materials and bio-based chemicals are listed as the research core, and the development of downstream material applications and business models has been vigorously promoted.

Meihua Bio, the leading amino acid company in China, Cathay Biotech, a leader in bio-based dibasic acid, and Jindan Technology, a leader in the lactic acid industry, are all leaders in each sub-industry. While doing a good job in chemical business, it is actively deploying downstream bio-based materials.

2. The road to industrialization of new technologies

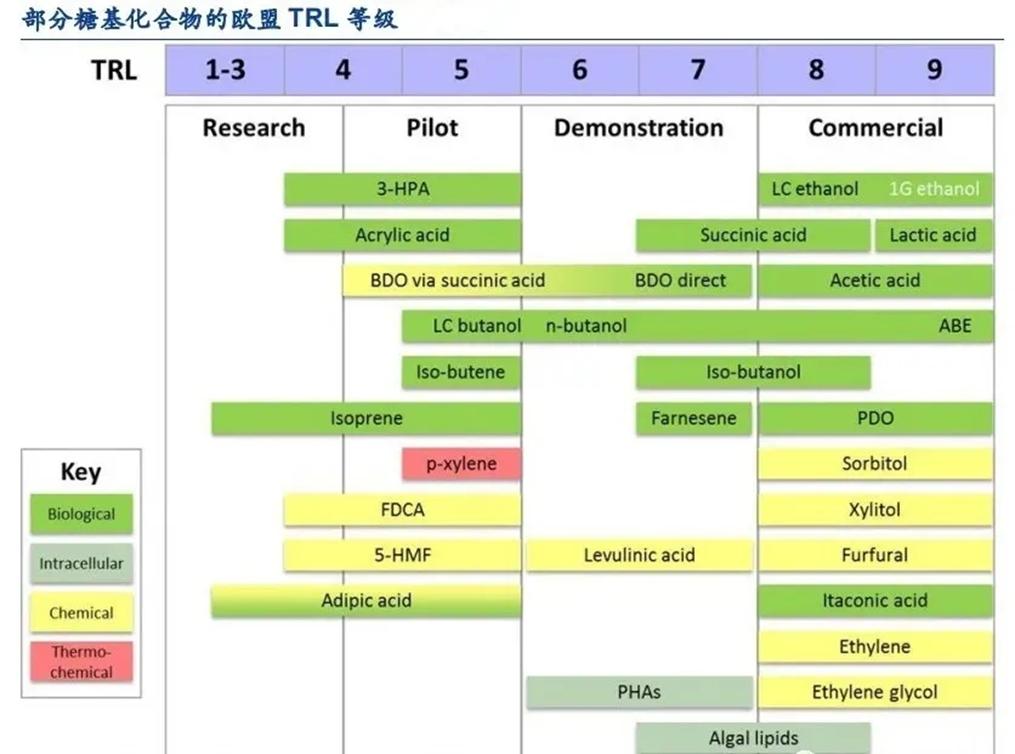

Before establishing a commercial plant, a new transformation technology usually goes through a development path from a small laboratory test to a scale-up, and then to a pilot test. This is especially true for most bio-based products (especially biological routes). in this way.

The number of years required for the commercialization of biological products largely depends on the technical route and the economics and compatibility of the products themselves (compared with the benchmark petrochemical-based products, whether the original petrochemical supporting facilities match the biotechnological route and the bio-based Whether the product performance matches the downstream equipment and demand, etc.), the type of transformation technology and the partnership (upstream and downstream supply chain integration).

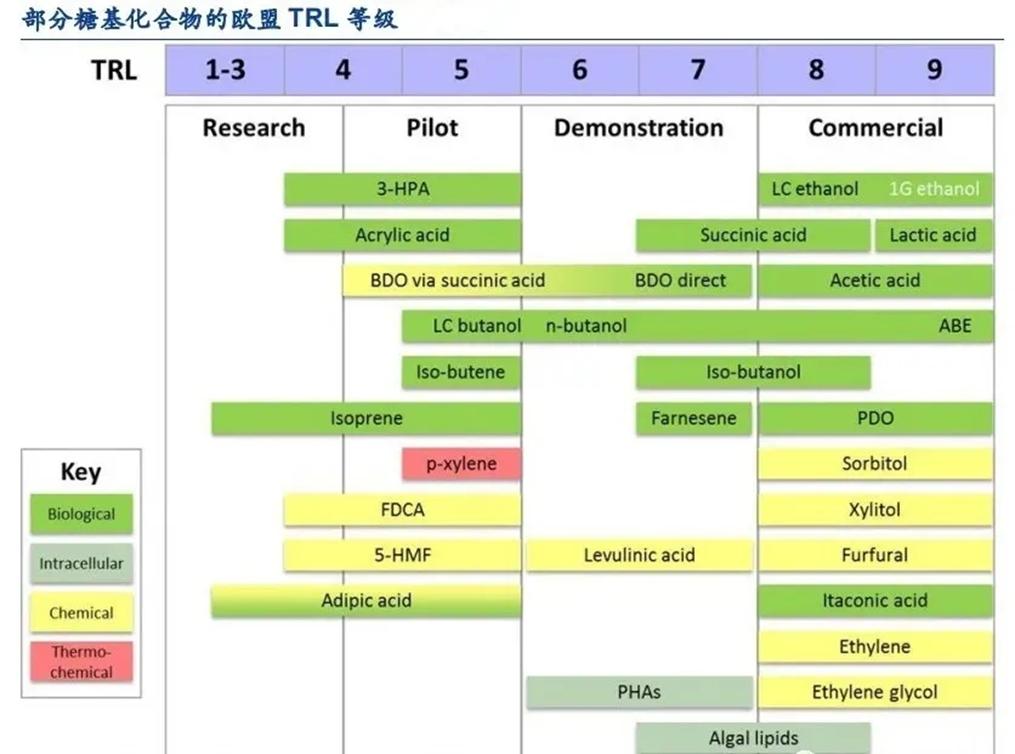

Technology Readiness Level (TRL) is an important indicator to measure the technological maturity of bio-based projects. According to the EU Horizon Plan, TRL levels are divided into levels 1-9, corresponding to the small test verification stage (level 1-3). Scale-up stage (level 4-5), pilot stage (demonstration facility, level 6-7) and commercialization stage (level 8-9).

According to JRC research, under a supportive policy environment, it may take about 10 years for general bio-based chemicals to go from TRL5 to TRL8. Therefore, this stage is also known as the "valley of death". A typical example is PLA and TRL8. The development history of the upstream lactic acid industry;

However, when traditional downstream processes are used (such as the transition from chemical to biological methods), certain steps (such as equipment compatibility testing) can be skipped to speed up this process and increase the success rate of commercialization of bio-based products. At present, most of the small-scale R&D and pilot-scale facilities are located in Europe and North America, of which North America is the majority, and Asia (mainly China) dominates the manufacturing of bio-based products in the commercialization stage.

Bio-based plastics: emerging markets are at the starting point of rapid growth

1.Bio-based plastics are currently the most important application field for downstream materials of bio-based chemicals

As the name implies, bio-based plastics refer to new materials whose raw materials are wholly or partly derived from biomass (corn, sugar cane, cellulose, etc.). According to whether it can be decomposed into small molecular compounds by microorganisms (bacteria, molds, algae, etc.) under certain conditions, bio-based plastics are divided into biodegradable and non-biodegradable plastics.

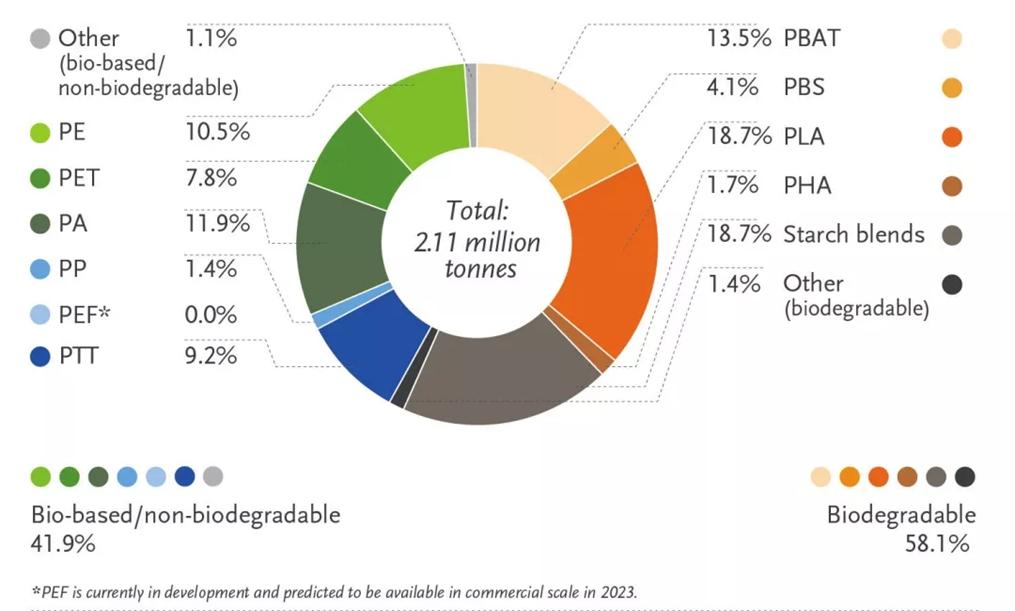

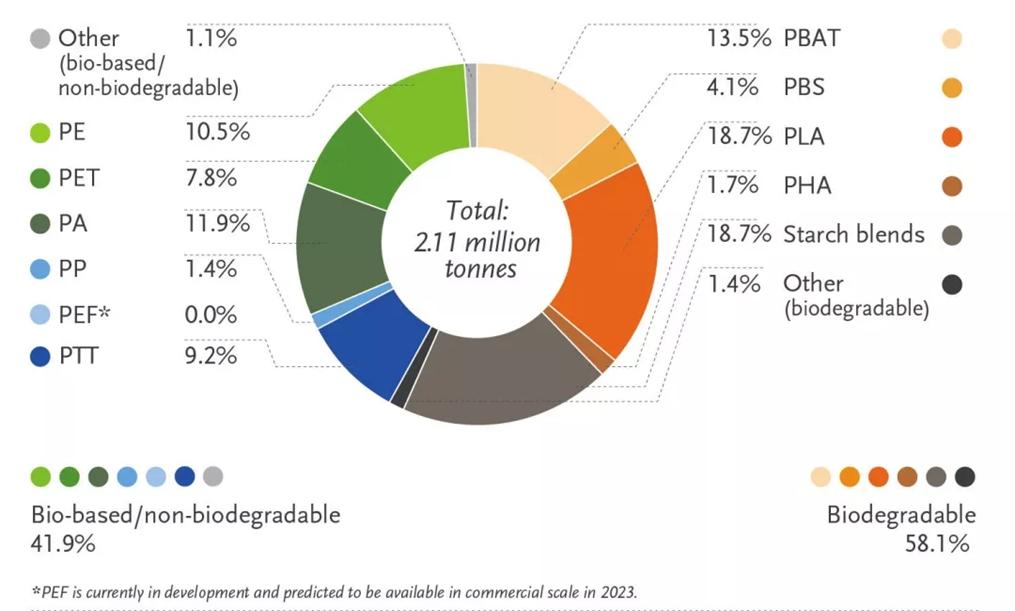

European Bioplastics data shows that bio-based polyhydroxyalkanoates (PHA), polylactic acid (PLA), polybutylene succinate (PBS), adipic acid/butylene terephthalate (PBAT) And starch-based plastics are both biodegradable plastics.

And bio-based polyethylene (PE), polypropylene (PP), propylene terephthalate (PTT), polyethylene terephthalate (PET), nylon (PA) series and polyethylene furanate ( PEF) etc. are not biodegradable.

Bio-based plastic products have two main advantages: (1) Excellent emission reduction capabilities. The carbon dioxide emissions of bioplastics are only 20% of that of traditional plastics; (2) Some plastics are naturally biodegradable and non-degradable. The base plastic can also be recycled and reused.

In 2018, the global production of plastics was nearly 360 million tons, and the output of bio-based plastics in 2020 was nearly 2.11 million tons, accounting for less than 1%. In recent years, with the growth of demand and the emergence of more and more bio-based polymers, applications and products, the bioplastics market has continued to grow.

According to MarketsandMarkets forecasts, the global bioplastics and polymer market is expected to be USD 10.5 billion in 2020. Driven by the industrial support policies of various governments, it is expected to grow to USD 27.9 billion in 2025, with a compound annual growth rate of 21.7%.

The top five bio-based plastics in the world are starch-based plastics (19%), PLA (19%), PA (12%), PE (11%), and PTT (9%). PBAT (13%) accounts for nearly 80% of total production. %.

In terms of regional distribution, Europe is the main hub of the entire bioplastics industry and a relatively mature area for bioplastics development. It occupies a pivotal position in the research and development of bioplastics and is the world's largest industry market. However, the market growth rate of bioplastics in Europe is relatively low, with output accounting for 26% in 2020, which is lower than 46% in the Asia-Pacific region.

The Asia-Pacific region is an emerging market. As a major production center, about 70% of the world's injection molding infrastructure is located in Asia, so the market is growing at the fastest rate. North and South America totaled 27%. In recent years, the output has increased year-on-year, and the market space is large. It is a bright spot for the promotion of bioplastics in the future.

2. The application range of bio-based plastics is becoming more and more diversified

Bio-based plastics are mainly used in packaging (hard packaging, flexible packaging), textiles, automobiles and transportation, consumer goods, agriculture and gardening, coatings and adhesives, building and construction, electronics and electrical appliances, and other industries. Bioplastics are suitable for packaging industry due to their good gloss, good barrier, electrical resistance and printing properties. Therefore, the packaging industry is the largest application field of bioplastics, accounting for about 47% of the total bioplastics market, nearly 1 million tons.

Bio-based PET accounts for the largest proportion of bioplastics used in rigid packaging. For example, all beverages of Coca-Cola are packaged in PET bottles, while bioplastics used in flexible packaging account for the largest proportion of biodegradable starch mixtures.

The bioplastics used in textiles account for about 11% of the total bioplastics, and the largest proportion is PTT. The largest proportion of bioplastics used in automobiles and transportation is bio-based PA. It is worth mentioning that PLA also has many applications in the packaging and textile fields because of its good use and processing properties. Bio-based plastics have a wide range of applications, and their market prospects are very impressive.

English

English 日本語

日本語 한국어

한국어 français

français Deutsch

Deutsch Español

Español русский

русский português

português العربية

العربية ไทย

ไทย Malay

Malay

.jpg)